Bussiness

Winters in Europe will be cheaper – London Business News | Londonlovesbusiness.com

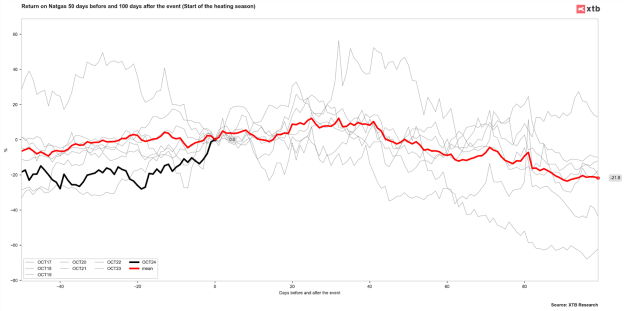

October and November are typically the most volatile months for natural gas prices. 2024 is no different.

It is when investors shift their focus from the summer season to the heating season, for which the entire market has been preparing for practically the entire year.

Although the demand for electricity generated from gas has been growing significantly in recent years, it is in winter that natural gas consumption significantly exceeds production capacity.

That is why the level of stocks just before the start of the heating season shows us whether we can feel safe or if a situation similar to 2021 and 2022 may occur when the gas market experienced enormous volatility due to Russia‘s actions in the form of restricting supplies to Europe, and then starting the war in Ukraine.

What will happen next with gas prices in the US and Europe? What should investors pay attention to? Is more and more expensive natural gas in the US a problem for European consumers, or even quite the opposite?

The heating season is just around the corner

The start of the heating season in Europe and the US usually takes place at the beginning of October. It is then that the amount of gas injections to storage facilities begins to be less than the amount of gas withdrawn from storage. The level of storage before the start of the heating season and the rate of withdrawal of gas from storage have a huge impact on price movements. What is the current state of natural gas storage in Europe and the US?

Europe’s storage facilities are currently filled to almost 94%. This is slightly below the levels of 2019, 2020, and 2023, but this is also due to lack of pressure to replenish inventories as demand is significantly lower than before. At the same time, the storage level is above the 5-year average, which is currently 89%.

However, this lower level is related to 2021, when storage filling at this time of year was only 72%. It was in this year that Russia began to restrict supplies to Europe, probably preparing for war and trying to make Europe even more dependent on supplies of their energy commodities. However, Europe coped with the problem quite well, significantly reducing consumption and diversifying supplies, using primarily pipe gas from Norway and LNG from the US.

At the moment, it seems that Europe is secured before the start of the heating season, although prices seems to be elevated, looking at the years before 2021. Currently, market participants pay around 36 EUR for 1 MWh of gas on the Amsterdam exchange (TTF). However, this is almost 10 times less than at the peak in August 2022. However, looking at global prices, in Europe we already have a price drop below delivery prices for Japan, Korea, and China.

Global natural gas prices in US dollars per million British thermal units. The price in Europe currently does not exceed $12/MMBTU, while in the US it is increasingly approaching $3/MMBTU.

However, it should be remembered that the costs associated with liquefying and transporting gas are around $8-10/MMBTU. That is why spectacular arbitrage is not possible in this case. Source: Bloomberg Finance LP, XTB

American natural gas fundamentals

The storage situation in the United States is slightly different. A very warm autumn and winter of 2023-2024 led to storage facilities being filled 39% more than the 5-year average at the end of the heating season this spring. US gas price was scraping the bottom for much of the year, and some expected that the level of $1.5/MMBTU, which occurs extremely rarely on the market, would not be the lowest level this season.

However, it is worth remembering that at such a price, a smaller and smaller part of the production was profitable, which met with communication of capital expenditure restrictions from upstream companies in the US. Then the summer period came, in which gas consumption due to heat was exceptionally high. It should be emphasized that over 40% of electricity in the US comes from gas-fired power plants, so increased air conditioner usage also generated significant gas consumption.

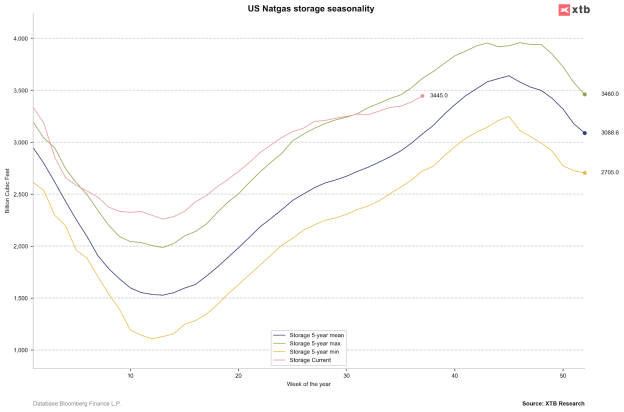

Although the current level of stocks remains about 5% above last year and about 8% above the 5-year average, the pace of rebuilding stocks is the slowest in years. It cannot be ruled out that the heating season will begin with a stock level around the 5-year average, which would justify higher price levels than now. However, the key issue for further price movements will be how much gas will be consumed later in the heating season.

US natural gas storage levels. The rate of increase is significantly lower than in previous years. If the winter is severe, natural gas prices could be much higher than they are now, considering production issues. Source: Bloomberg Finance LP, XTB

Producers in the US are starting to struggle

US gas production reached record levels of around 106 billion cubic feet per day at the beginning of this year. However, production has fallen significantly, and although it remains above the 5-year average, the lack of new investments may mean that the next year will not bring record production. Of course, this could change if Donald Trump becomes president.

He is known for his support of conventional energy sources and using the country’s own resources, so support for the upstream sector cannot be ruled out. However, further production growth in the US requires significantly higher prices, as was the case in 2021 and 2022.

More LNG for Europe?

It is worth remembering that the United States recently became the world’s largest exporter of liquefied natural gas, with a market share exceeding 20-21%. The US dominated this position, surpassing Australia and Qatar. However, it is worth remembering that the US took a very large part of the European market, as almost all gas supplies from Russia to Europe were stopped.

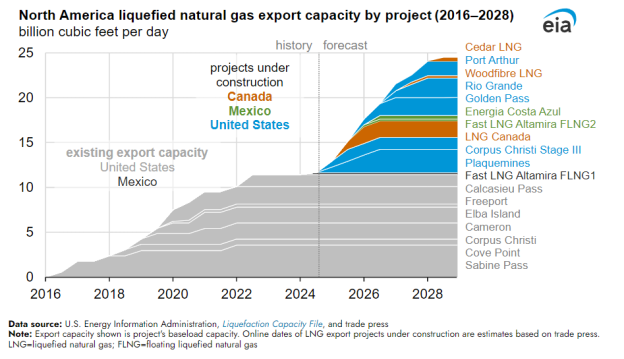

LNG exports from the US exceed 12 billion cubic feet per day this year and it may be much higher in the next years. However, this is still relatively small amount, considering production exceeding 100 bcfd and average consumption around 80 bcfd. At the turn of 2024 and 2025, new export terminals Plaquemines and Corpus Christi Stage III will start their operations.

They will bring about 2 bcfd capacity next year and at the beginning of 2026 additional 1 bcfd of export capacity. But that’s not all. By 2028, together with Canada and Mexico, export capacities will be increased to almost 25 billion cubic feet per day. That’s twice as much as now. This means more natural gas available for the whole world, including Europe.

Although it is difficult to expect a return to prices of EUR 15-20/MWh, which took place before 2021, the new export potential from North America may permanently lower prices in Europe below EUR 30/MWh. At the same time, this means less gas in North America itself, without production or imports increase.

Theoretically, the use of the full new export capacity by the US next year may lead to a lower gas stocks by 500-700 bcfd at the start of the heating season in 2025 (assuming no change in consumption, production, and imports from Canada). Therefore, the next year may bring the lowest stock level in 5 years, before the start of the heating season. In such a case, prices should be much higher than the current range of $2-3/MMBTU. However, higher prices in the US may do not mean higher prices in Europe.

According to the EIA, significant growth in export capacity from the US and other North American countries is expected in the coming years. By 2028, export capacity could double. Source: EIA

What about prices?

The volatility of the October and November futures contracts in the US is usually significantly increased. The price of the October contract increased by 10% in August. A similar situation occurs in the quotations of the November futures contract, which since rolling over from the October contract has already gained over 10% and the price is approaching the level of $3/MMBTU.

The seasonality of the gas market causes large differences between individual futures contracts. Currently, the November contract is traded at $2.8/MMBTU, while the January one (which is usually the highest in the futures curve) is already traded at $3.6/MMBTU. The price for January 2025 already reflects the likely lower available supply in the US, as the contract is traded at $4.2/MMBTU.

The situation is completely opposite with European gas. The possible greater available supply in the future means that the prices of futures contracts from 2027 onwards indicate prices below 30 EUR/MWh, although the next year should be quite stable between EUR 36-38/MWh.

In such conditions can we expect a price correction on the NATGAS? Everything will depend on the weather. At the moment, forecasts do not indicate a high probability of harsh winter, which may suggest similarly low gas consumption in the coming months.

With the next contract rollover in the second half of October, US natgas prices could face downward pressure. While seasonal trends typically see prices peaking in November, the underlying fundamentals suggest a potential for significantly higher prices in the medium to longer term. However, if Natgas consumption during the early heating season remains low, even at the relatively low price range of around $3-3.5/MMBTU, a substantial two-digit price correction may be expected.

The trend of natural gas prices in the US at the beginning of heating seasons in recent years. Source: Bloomberg Finance LP, XTB