Football

Dollars and sense. US appetite for European football clubs is insatiable – Inside World Football

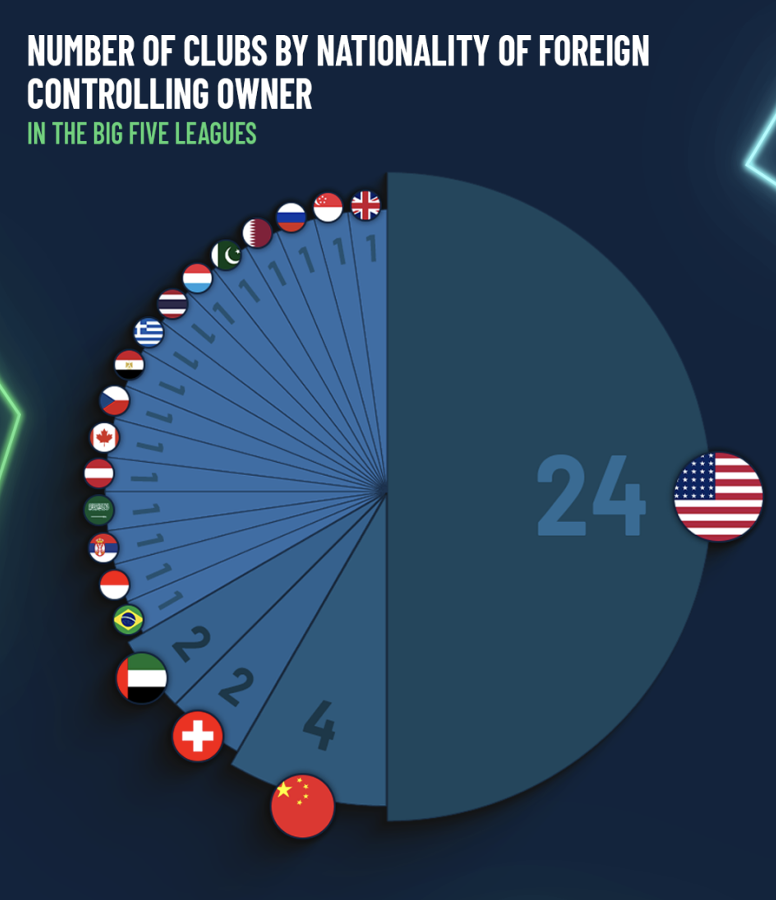

October 18 – The growth of non-domestic ownership of clubs in Europe’s Big 5 leagues is no longer a new phenomenon, but the skew towards US ownership in England’s Premier League and Italy’s Serie A has been a growing one.

A report by Football Benchmark catalogues the number of US investors who now control 24 clubs in the Big 5 leagues, 10 of them in England and eight in Italy. Widening beyond the US, 27 clubs are now owned by North American shareholders.

The report says the attractiveness of European clubs is driven “by two key factors: low acquisition costs and substantial growth potential”. Add to this the belief amongst US investors that there is unlocked revenue potential.

The low cost of entry in comparison to US sports franchise ownership suggests that American investment is not about to dry up.

The Football Benchmark highlights the Italy Serie A as particularly attractive for US investment because of the greater opportunity for revenue growth compared to the already high achieving Premier League.

“In Serie A alone, nine clubs—Atalanta, Bologna, Fiorentina, Genoa, Inter, Milan, Parma, Roma, and Venezia—are under North American control. With Genoa potentially changing hands due to 777 Partners’ default, another North American owner could soon enter the Italian football scene, as Italian-American investor Mario Gabelli is in talks for Monza,” says the report.

Football Benchmark do point out Germany as an outlier when it comes to foreign ownership with RB Leipzig being the only club under foreign control, with its majority stake held by Austria-based Red Bull. In contrast the English Premier League has just three clubs with UK-based majority owners, and the remaining 17 are controlled by foreign entities.

The report concludes: “When American investment funds and entrepreneurs found themselves flush with liquidity, many turned their sights toward football, recognizing a unique opportunity. They had two significant advantages: substantial purchasing power and deep connections within the media and entertainment industries. European football, to these investors, often resembles American professional leagues—a commercial spectacle ripe for exploitation through evolving marketing strategies and the global reach of the sport.”

But it has not always been plain sailing: “Despite ambitious plans, American owners have repeatedly run into bureaucratic and political obstacles, slowing their efforts. There’s a risk that continued frustrations may eventually cause some to rethink their investments, possibly leading to a retreat.”

However, that is unlikely to happen just yet.

“Chelsea FC and AC Milan, the two biggest US-led acquisitions in 2022, were sold at €2.9 billion and €1.2 billion, respectively. These figures, while significant, pale in comparison to the valuations seen in major American sports leagues, keeping European football an enticing option for North American investors,” says the report.

Contact the writer of this story at moc.l1729216765labto1729216765ofdlr1729216765owedi1729216765sni@n1729216765osloh1729216765cin.l1729216765uap1729216765