Fashion

European TV Still Peaking Amid Fears of a U.S.-Style Downturn

European TV has not peaked. At least not yet.

While the U.S. TV business has seen a sharp downturn, with a drop in the number of shows commissioned and broadcast and headline-making layoffs across the major studios, European TV production is still on the upswing, according to a new report by think tank the European Audiovisual Observatory (EAO), which presented its findings at a keynote at TV festival Series Mania on Tuesday.

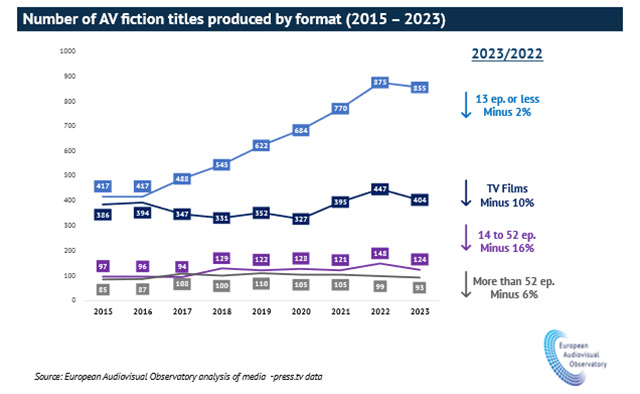

There were 873 fictional series produced for broadcast and streaming platforms in Europe in 2022 — the last year for which the EAO has data — up from 775 in 2021 and a new record, the group found. This compares to a drop, from 600 to 516, in new fictional series produced in the U.S., according to figures from FX.

Europe can thank the streamers. The EAO found spending by global streaming platforms jumped 70 percent year-on-year in 2022 to $5.3 billion (€4.9 billion), accounting for just under a quarter of all spending on original European content. The streaming push — driven both by a bid to acquire market share and for a need to meet EU regulations on European content quotas —has been a tide that lifts all boats, as competitor broadcasters, both private and public, have also plowed more money into production to keep up.

But, the EAO warns, Europe may just be lagging behind the U.S. and that the drop is coming. The report notes that some streamers have announced they will limit their investments in non-US content. While there has been strong nominal growth in Europe’s TV business — the Euro audiovisual market grew by 5.6 percent in 2022 to just over $140 billion (€130 billion) — 60 percent of that growth came from the streaming boom and, adjusted for inflation, the remaining sector is in long-term decline.

Streaming largesse has also been spread unevenly across Europe, with productions in the U.K. and Spain together accounting for more than half (55 percent) of global streamer spending on original European content. The Netflix-driven boom in Spanish television in particular — think of Netflix’s global hit Money Heist and its recent spin-off series Berlin — could make the local industry particularly vulnerable to a downturn.

The EAO had a similar warning for Europe’s production companies, including giants ITV Studios, BBC Studios, RTL’s Fremantle and France’s Banijay, which have enjoyed boom times thanks to streamers and increased commissions. But “the growth of streamers’ investments in European works should not be taken for granted at a time when most of them are not profitable yet,” noted the EAO report.