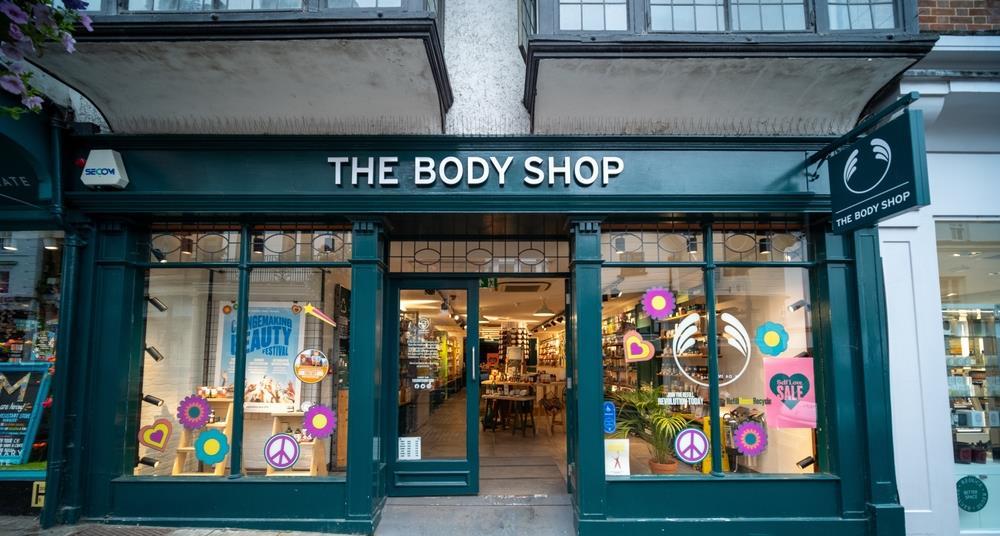

Shopping

Exclusive: Over 2,000 jobs at risk as The Body Shop’s European businesses left in limbo

A source with understanding of The Body Shop’s situation in Europe said staff had a group video call last week with Alma24 director and majority shareholder Friedrich Trautwein. During the call, Trautwein told staff his company was only responsible for Belgium, Germany, Austria and Luxembourg, with the remaining businesses being left in the dark as to their fate.

On the call, Trautwein also told staff that Alma24 had attempted to aquire The Body Shop’s Swedish and Danish businesses, but had been unable to reach an agreement with Aurelius.

The source said that now staff in France, Spain, Portugal, Denmark and Sweden don’t even know who is running their businesses, what the future of the brand in those countries is, or whether they’ll even be paid this month.

“We are trying to understand who our employer is, if it’s not this family office, and unfortunately no one is getting back to us from The Body Shop International, Aurelius, or the UK administrators [FRP Advisory],” said the insider.

The source added operations in the region have suffered because The Body Shop’s head office in the UK has failed to pay its third-party distribution centre in Frankfurt, Germany.

The various websites for The Body Shop are currently down in each of the countries as a result, meaning ecommerce orders have been left unfulfilled.

“We have a number of ecommerce orders waiting to be shipped but I’m afraid we are going to have to cancel them. It’s a terrible situation,” the source added.

Employee exit costs

The news comes less than a week after the retailer’s UK, German and Belgian arms all collapsed into administration, putting a further 2,000-plus jobs at stake.

Aurelius offloaded The Body Shop’s loss-making European and Asian businesses at the end of January for an undisclosed figure to an unnamed ”international family office”, understood to be Alma24.

At the time The Body Shop said most of its business in mainland Europe, including some sub-franchise partners, were involved in the sale.

One source familiar with the retailer said the Body Shop’s business in continental Europe has been a drag on the company’s overall profits and closing down its operations in Germany would cost the retailer close to €20m due to high levels of employee protection in the territory.

A similar situation in France, combined with strict employee protection rules, would bring the cost of exiting these markets up to between €30m to €40m.

After the retailer’s German branch went into administration, the source said other markets in Europe could be headed for a similar fate.

Redundancy payments for markets affected by any future or present administration would not be paid by either Aurelius or Alma24, but would end up costing the taxpayer in those regions instead.

Aurelius said it was not a shareholder in Alma24, but that it had done business with the firm in the past.

However, Companies House filings for Alma24 show the firm has links to Aurelius via its director Friedrich Trautwein.

Trautwein was appointed interim chief executive of Ideal Shopping Direct under Aurelius’s ownership, and he has previously been director of companies linked to Aurelius-owned groups including Autostore and Bertram group. Six out of nine firms headed by Trautwein are now dissolved or in liquidation.

Retail Week tried to reach out to Alma24 for a comment, but the firm has no website, corresponding email address or contact number.